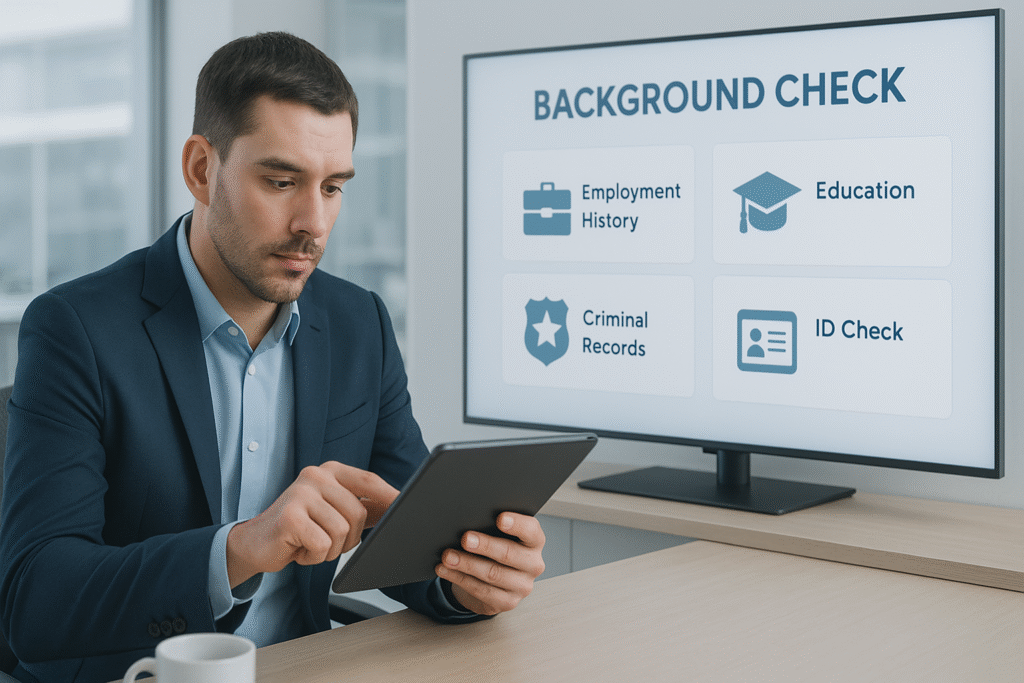

Hiring the right person isn’t just about finding a good resume—it’s about making sure what’s on that resume is actually true. And in today’s world, where a small hiring mistake can turn into a big business risk, background checks aren’t just nice to have—they’re a must.

But here’s the thing: not all background checks are the same. Depending on the role, industry, and level of risk, different types of checks serve different purposes.

So if you’re an employer, HR professional, or startup founder trying to build a reliable team, let’s walk you through the essential types of background checks every organization should know about.

Employment History Verification

Let’s start with the basics. You want to make sure your candidate has actually worked where they said they did.

What it covers:

- Past job titles

- Duration of employment

- Responsibilities and achievements

- Reasons for leaving

Why it matters:

Exaggerating job roles or experience is more common than you think. This check helps you verify if the candidate has the right skills and work ethic for the role.

Tip: Always verify at least the last 2-3 employers or last 5–7 years of employment.

Read More about Employment Verification

Education Verification

Imagine hiring someone as a financial analyst, only to later discover their “MBA” was self-proclaimed. Yikes.

What it covers:

- Degree authenticity

- Course completion status

- Grades or honors (if relevant)

- Institution accreditation

Why it matters:

Certain roles—especially in finance, healthcare, and legal fields—require specific qualifications. Verifying education ensures you’re not hiring someone under false pretenses.

Criminal Record Check

Nobody wants to think the worst, but you can’t ignore due diligence when it comes to safety and compliance.

What it covers:

- Criminal convictions

- Pending charges

- Court appearances

- Arrests (in some jurisdictions)

Why it matters:

Hiring someone with a serious criminal record—especially for roles involving money, clients, or sensitive data—can expose your business to legal and reputational risk.

Note: Always follow local labor laws and consent rules while conducting criminal checks.

Address Verification

It might sound simple, but verifying someone’s residential address is a key part of verifying their identity.

What it covers:

- Current and permanent address

- Residency duration

- Cross-check with valid documents (like utility bills, Aadhaar, etc.)

Why it matters:

A confirmed address can help in verifying a candidate’s identity and locating them for legal or operational reasons later. It’s especially useful when combined with ID checks.

Identity Check (ID Verification)

This one’s about making sure the person is really who they claim to be.

What it covers:

- Government-issued ID (Aadhaar, PAN, Passport, Voter ID)

- Cross-verification with official databases

- Age, gender, and nationality validation

Why it matters:

Identity fraud is real—and costly. Verifying IDs helps you prevent impersonation and fake profile risks.

Reference Check

While not a technical check, reference calls still carry weight in understanding a candidate’s behavior and performance.

What it includes:

- Speaking with former managers or peers

- Feedback on work ethic, behavior, and leadership

- Insight into collaboration and attitude

Why it matters:

Sometimes, you just need to hear what it was like working with the person. References provide context beyond the resume.

Credit Check (Financial Background)

This one’s more specialized—but extremely important in certain sectors like banking, finance, and security roles.

What it covers:

- Credit score

- Outstanding loans or defaults

- Bankruptcy history

Why it matters:

A poor credit history might indicate risky behavior, especially if the role involves handling money or financial data.

Important: This check is usually done only with consent and in compliance with laws like the RBI guidelines or global standards like FCRA.

Global Database & Watchlist Check

If you’re hiring for senior, global, or sensitive roles, this one adds an extra layer of security.

What it covers:

- Global criminal databases

- Interpol or terrorist watchlists

- Sanctioned individuals or politically exposed persons (PEPs)

Why it matters:

This type of screening is especially useful for multinational companies or businesses involved in high-risk industries like fintech, law, or defense.

How Screenaze Can Help

At Screenaze, we provide a comprehensive, fast, and fully digital background verification solution trusted by 500+ companies across India. Whether you need basic screening or a full suite of background checks, we’ve got you covered.

Our team takes care of everything—from document collection to verification—so your HR team can focus on what they do best: hiring great talent.

Need help choosing the right checks for your business?

Contact Screenaze today for a customized BGC verification solution built for your hiring needs.